Start company

Manage finances

Personal Tax

Step-by-step guide to starting a business in Switzerland

Step-by-step guide to starting a business in Switzerland

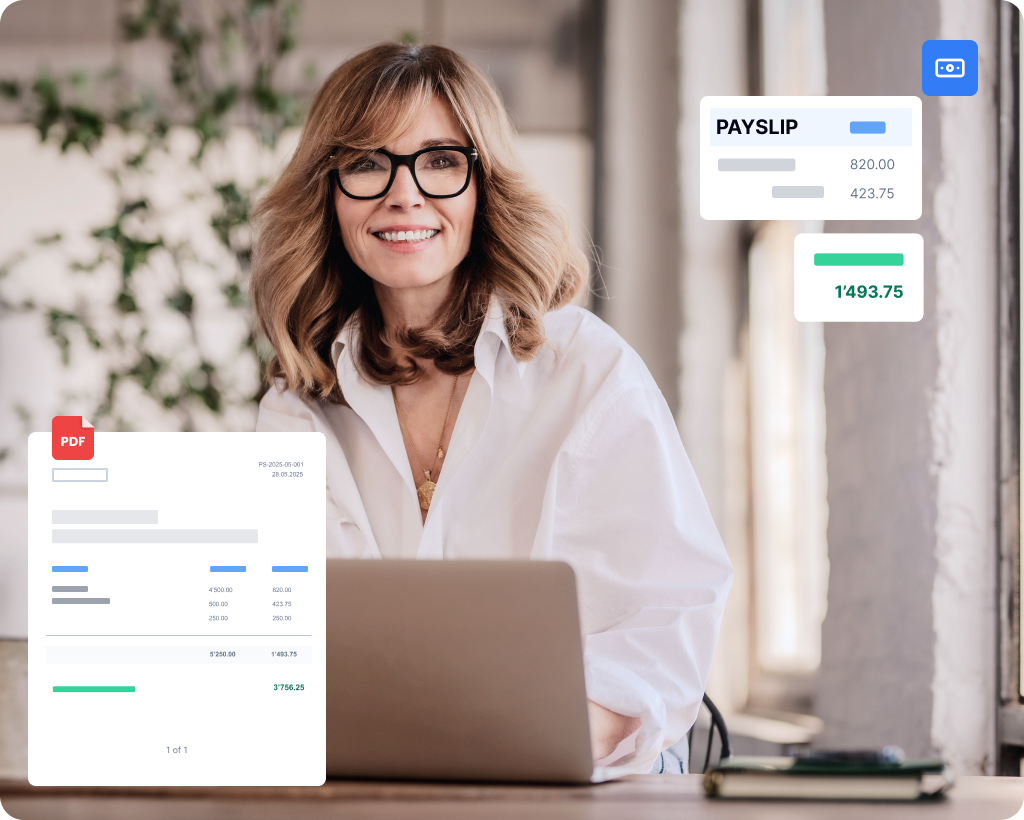

Leave the complexities to us and enjoy seamless payroll processes every month.

Cut down on errors and administrative workload

Ensure the accurate processing of all salary types

Both fixed and variable salaries are handled properly, with precise deductions and strict adherence to Swiss labour regulations.

Stay compliant with canton- and industry-specific labour laws

We manage all contributions and deductions, and submit monthly and annual salary reports on your behalf, ensuring everything is handled in accordance with legal standards.

Simplify mass salary payments

Obtain bank-specific, upload-ready DTA payment file for all your monthly salary payments – no manual entries required.

Our specialists issue accurate, legally compliant monthly payslips for employees with fixed income. All deductions, including social charges, taxes, and pension contributions, are meticulously calculated.

We deliver professionally formatted payslips in PDF format with your company branding and prepare annual salary certificates.

All social contributions and deductions are handled in accordance with your insurance policies.

We handle variable compensation, such as overtime and bonuses, and ensure compliance with Collective Labour Agreements (CLAs/CCTs). With in-depth knowledge of Swiss labour laws and specific CLA/CCT conditions, our experts process these payments accurately, simplifying complex payroll scenarios for you.

Whether it’s bonuses, commissions, or hourly adjustments, we take care of all the details, so your payroll stays smooth and error-free.

As part of our CCT compliance service, we provide the necessary monthly reports directly to the designated industry controlling authority.

We take care of the monthly reporting of source tax to the relevant Cantonal authorities on your behalf. Our service ensures that all employee deductions are calculated correctly and submitted on time, in accordance with the specific requirements of each canton.

At the end of the year, our specialists prepare and submit your company’s annual source tax declaration to the designated Cantonal administration. We reconcile all monthly reports with final yearly totals, keeping all your records complete.

Our experts manage local tax regulations, ensuring your payroll complies with each canton’s requirements.

All records are properly prepared, organised, and ready for review.

Our specialists support you with all the key documents required at every stage of the employment journey, including contracts, NDAs, amendment agreements, and termination letters. Each document is professionally prepared and aligned with legal and regulatory standards.

We provide tracking tools for employee hours and vacation days, helping you manage project time allocation, monitor workloads, and plan resources effectively.

In the event of workplace accidents, illness, or other health-related incidents, we handle the complete process from filing claims to submitting the necessary documentation. Our team manages each step with accuracy and diligence, maintaining compliance with insurance procedures and employer obligations.

On-time delivery

With our payroll processing services, we ensure all tasks are handled promptly from payslip preparation to salary payments. You can rely on us to meet deadlines consistently, empowering you to fully focus on your core business operations.

Legal compliance

Throughout our cooperation, we keep your payroll processes and employee documentation in full alignment with Swiss regulations. Our team stays informed about the latest legal changes, helping you avoid penalties and making certain that all practices comply with the law.

Data protection & confidentiality

Your financial information is secure with us. We manage and store all documents according to Swiss data protection laws (FADP), ensuring confidentiality and protected access at all stages.

All data is stored in Switzerland.

Our systems are designed to protect sensitive information from unauthorised access, and our team follows strict internal protocols to maintain your trust.

We guide you through every stage – right from the beginning

Book a consultation

Schedule a call with our expert to discuss your company’s unique requirements.

Pinpoint payroll challenges

During the conversation, we’ll uncover the payroll challenges you’re facing and discuss how we can help.

Get clear on pricing and next steps

We customise our pricing to suit your requirements. Once you get it, we’ll set up a plan to begin implementing the right payroll solutions for you.

Streamline workflows and drive better outcomes through seamless integration of technology and expert guidance

Company incorporation

Start your business with ease – we take care of the whole registration process, from initial consultation and name checks to notary representation and final confirmation.

Domiciliation

Meet Swiss legal requirements and simplify operations with our full-service solution – including c/o address, mail handling, secretarial help, and flexible workspace options.

Accounting

The entire financial record-keeping process done for you – bookkeeping, reconciliations, and reporting – all managed accurately and on time.

Financial reporting

Annual financial statements, monthly performance reports, KPI insights, and third-party documentation – get all essential reports for effective management.

Tax compliance

Simplify your tax management with expert-led filing, strategic planning, and tailored advice that uncovers saving opportunities.

Employee onboarding

Leave complex formalities such as contracts, legal checks, and staff policies to us and hire without the administrative overload.

Consulting

Gain clarity on your market position, identify growth opportunities, and find out what is slowing down your business performance.

Financial forecasting

Plan your operations using data-backed projections with insights into cash flow stability and upcoming financial needs.

Business optimisation

Spot outdated processes and replace them with efficient, automated solutions that reduce errors and speed up workflows.

Frequently asked questions

We provide payroll services for SMEs across Switzerland, covering a wide range of industries, including:

Our specialists understand the specific payroll requirements and operational challenges of each industry and deliver tailored solutions.

Yes. We provide payroll services for SMEs in all Swiss cantons, including:

You will be assigned a dedicated specialist with in-depth knowledge of your canton’s payroll rules and requirements. He will ensure accurate and compliant payroll management for your business.

Our Swiss payroll services include:

Our experts can assist you with a wide range of payroll solutions tailored to your business. If your company requires something different, simply book a consultation to discuss your specific requirements. During the meeting, we will assess your needs in detail and prepare a customised proposal.

Pricing is based on the services you choose, the complexity of your payroll, and the size of your team. To get a clear view of the exact costs for your business, visit our pricing page and select the options that match your needs. We will review your selections and send you a tailored proposal with transparent pricing and next steps.

Yes. You will be assigned a dedicated payroll specialist who will gain an in-depth understanding of your business processes and requirements. Whenever questions arise, you can rely on this person for clear guidance and timely support.

Our specialists provide payroll management services in all local languages used in Switzerland, plus English. We tailor our approach to your business location and preferences, ensuring that all payroll processes are clear, accurate, and easy for your team to understand.

Our payroll solution works with your existing accounting, ERP, or HR software. You don’t need to switch systems.

Step 1: Choose the services you need

Once you’ve identified the payroll services your business requires, visit our pricing page and add them to your customised plan.

If you need something specific or are unsure which payroll management solution is most suitable for your company, book a consultation and our expert will help you.

Step 2: Receive a tailored proposal

Our specialists will review your selections, consider the specifics of your business, and send you a personalised proposal with clear pricing directly by email.

Step 3: Schedule a consultation with our specialist

Before moving forward, it’s important that our expert has a full understanding of your company’s payroll processes and requirements. During the consultation, we’ll review your setup in detail and answer all questions to ensure everything is accurately planned.

Step 4: Get everything ready

After the consultation, we help you organise all necessary documents, set up secure access to your data, and handle all preparations so everything works efficiently from day one.

Step 5: Ongoing support and payroll management

We provide ongoing payroll management services according to the customised plan created for your business. If any questions arise, you can contact us at any time – our specialist will provide a clear, detailed response.

Payroll data and sensitive employee information are managed with the highest standards of security. All information is processed and stored in accordance with the Swiss Federal Act on Data Protection (FADP), ensuring full adherence to local legal requirements.

Our systems are hosted in secure data centres located in Switzerland, with strict safeguards to ensure that payroll records are accessible only to specialists working under rigorous internal protocols.